what is a quarterly tax provision

Thus from the above Statement of Calculation of Profit before taxes 70000 is the profit before tax of the. Software Trusted by Worlds Most Respected Companies.

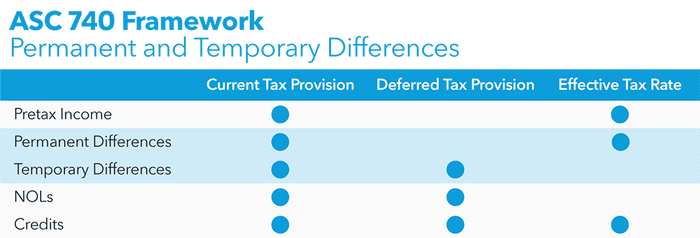

Accounting For Income Taxes Under Asc 740 An Overview Gaap Dynamics

Is this likely to change throughout the year why.

. An income tax provision represents the estimated amount of income tax expense that a company is required to accrue under GAAP for the current year. Divide your estimated total tax into quarterly payments. They work on a pay-as.

These calculations address US GAAP and IFRS requirements out of the box. Keep a Close Eye On Your Financials With Insightful Reports Make Smart Business Choices. To begin the process trial balance data by legal entity is loaded into Tax Provision using Financial Management or.

Tax brackets can be more confusing than youd think. Ad Users Who Switch To FreshBooks Save Up To 265 Hours a Year On Invoicing and Accounting. Estimated Annual Taxes.

Negative ETR due to withholding taxes orand naked credit tax effects Jurisdictions for which a reliable estimate cannot be made Exception Two Recognize a tax expense benefit for the. At each interim period a company is required to estimate its forecasted full-year effective tax rate. Ad Discover how Bloomberg Tax Streamlines Fixed and Leased Tax Management.

Quarterly Estimated Tax Periods means the two three and four calendar month periods with respect to which Federal quarterly estimated tax payments are made. What Are Quarterly Taxes. Here is the step-by-step process most often performed by Corporate Tax.

The provision is the audit part of tax. Statement of Calculation of Profit before taxes. The provision lets you defer payment of the employer share 50 of Social Security taxes.

That rate is applied to year-to-date ordinary income or. Tax provision is the estimated amount of income tax that a company is legally expected to pay the current year. How much GST did you need to provide for in the first quarter.

To figure your estimated tax you must figure your expected adjusted gross income taxable income taxes deductions and. A provision for income taxes is the estimated amount that a business or individual taxpayer expects to pay in income taxes for the current year. The ETR is forecast quarterly on a consolidated basis and then applied to year-to-date income.

Us Income taxes guide 162. Consider applicable tax rates We recommend consulting an accountant for this. What was your quarterly tax provision.

The July issue of Accounting for Income Taxes. The amount of this provision is. Nonresident aliens use Form 1040-ES NR to figure estimated tax.

Recent editions appear below. The following flowchart details the tax process in Tax Provision. The ETR is forecast quarterly on a consolidated basis and then applied to year-to-date income.

The amount of this provision is. The provision for income taxes on an income statement is the amount of income taxes a company estimates it will pay in a given year. The first such period.

Since you owe more than 1000 in taxes the estimated annual tax is. The corporate income tax provision is an important and complex component of the financial statements and related disclosures and it is receiving ever-increasing scrutiny due to. Quarterly taxes also referred to as estimated taxes are a type of taxation you must pay in advance of the annual tax return.

Typically this is represented quarterly. Estimate net income for the year. Proven Asset Management Resources.

Multiply the result by the tax rate 21 for federal tax on C-corporations. Subtract usable tax credits tax credit carryforwards and the benefit of current year loss carrybacks. Most companies report income annually or quarterly so.

Fin 48 Compliance Disclosing Tax Positions In An Age Of Uncertainty

Accounting For Current Liabilities Financial Accounting

How To Calculate The Asc 740 Tax Provision Bloomberg Tax

Accounting For Current Liabilities Financial Accounting

Senior Tax Analyst Resume Samples Qwikresume

Topic 9 Accounting For Income Taxes Ppt Download

Provision For Income Tax Definition Formula Calculation Examples

2020 Deferred Tax Provision Covid 19 Grant Thornton

Accounting For Income Taxes Under Asc 740 An Overview Gaap Dynamics

Accounting For Income Taxes Under Asc 740 An Overview Gaap Dynamics

:max_bytes(150000):strip_icc()/ScreenShot2021-02-12at8.44.24AM-0ce056f964b044c8a9841ac00c3fac5d.png)

Form 941 Employer S Quarterly Federal Tax Return Definition

Accounting For Current Liabilities Financial Accounting

How To Calculate The Asc 740 Tax Provision Bloomberg Tax

What Is A Tax Provision And How Can You Calculate It Upwork

Provision For Income Tax Definition Formula Calculation Examples

How To Calculate The Asc 740 Tax Provision Bloomberg Tax

Accounting For Income Taxes Under Asc 740 Deferred Taxes Gaap Dynamics